Shared Services and Outsourcing – Current state overview

Share

As the US timidly hovers out of recession, great concerns remain about the fate of the Eurozone. Mauritius has a strong dependence on the Eurozone for its exports, while most of its imports are made in US Dollars. As the Dollar strengthens against the Euro, and the purchasing power from the Eurozone dwindles, it becomes even more important for our country to increase its resilience, both at macro and micro level.

This is the first of a series of articles that will address one of the ways companies worldwide have resorted to in order to contain their costs, increase productivity, and improve resilience: this business model is referred to as “Shared Services and Outsourcing” (SS&O).

Shared Services specifically describes an arrangement whereby different business units decide to have common processes performed through a centralised team. We refer to Outsourcing when an organisation chooses to have a business process or function (or part of it) carried out by a third party. Organisations choose SS&O for many reasons, of which the appeal of managing a service level agreement (SLA), lower cost of operations, and improved business processes, rank quite high.

For an SS&O initiative to be truly successful, it must form part of a broader corporate strategy. In too many instances, corporate functions act alone and fail to provide a convincing crossfuntional business case. For example, IT organisations may attempt to invest in applications without close linkage to operations, marketing or other important operational functions.

While these initiatives are often successful at providing benefits to the individual function, research shows that these initiatives have failed to improve comprehensively the broader strategic objectives of these organisations.

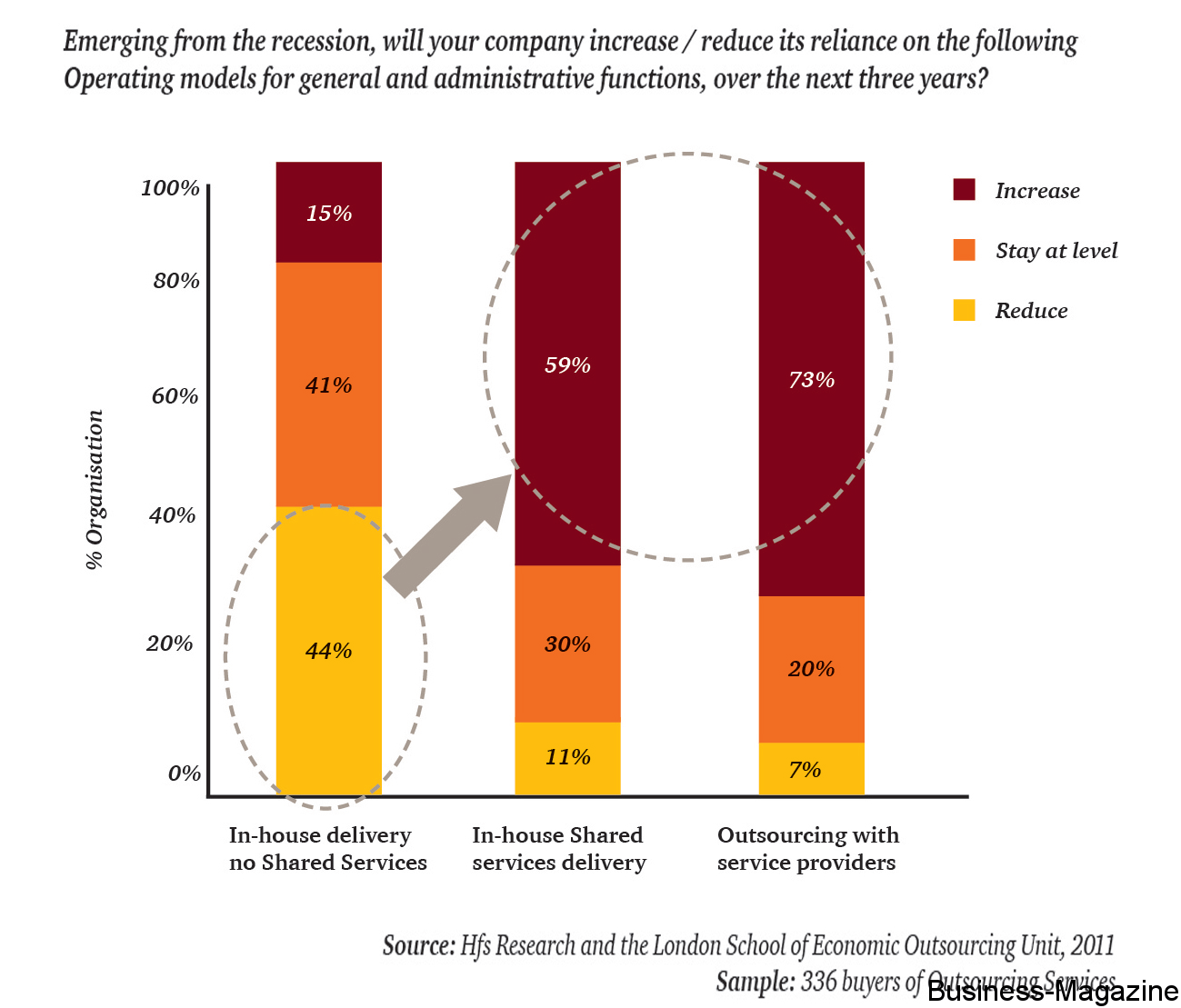

As shown below, “44 percent of organisations seek to reduce their in-house delivery capabilities and shift to shared services (59%) or outsourcing (73%) models”.

PwC and HFS Research (a research organisation specialising in outsourcing) go on to say that, if these organisations keep the piecemeal approach to SS&O, they’ll likely repeat the same failures.

PwC and HFS Research further comment that “organisations need to focus on aligning corporate strategy, improving investment portfolio decisions and reallocating current spending. To do so, they are adopting global business services models. The executives at these enterprises are corralling their functional leaders and thirdparty service providers to assess common business practices and operationalise their companies’ strategic global objectives. Then, they are together making three to five year technology decisions to address the most challenging issues, such as applications consolidation and establishment of common business processes. To accelerate these changes, these companies are leveraging economical shared services and thirdparty relationships to develop process acumen, reduce labour costs and consolidate operations”.

Against this backdrop, the SS&O industry in Mauritius has grown considerably over the past few years - despite the global economic slowdown - and demands from the industry have generally met a positive response from Government such as a legal framework facilitating the hire of foreign labour, investment in SAFE cable, etc. Today, Mauritius is asserting itself, slowly but surely, as a Regional Hub and the ideal entry point for multinationals doing business in Africa.

Considerable investment in structure, technology and talent is being made by service providers in Mauritius, largely for the account of major clients from North America and Western Europe. We also see a rising interest from the Far East that sees Mauritius as an ideal base from where to develop and control their operations on the African continent.

This investment in technology and up-skilling could greatly benefit Mauritian businesses, but we have not seen them catching the SS&O tide as such. We note that there is a move towards consolidating repeatable processes to be delivered from shared service centres, but beyond cost reduction and some standardisation, such initiatives tend to taper off.

There is a clear preference for the larger conglomerates to keep their shared service centres internal. This could be due to concerns around data confidentiality, perceived loss of control over an important part of the business, or an unwillingness to lay off people.

This looks very similar to the start of the SS&O lifecycle in the US around 3 decades ago, but we have one big advantage. We do not need to go through the same learning curve, but can rather leapfrog to where the leading global organisations stand today. GE, for example, is well known for outsourcing all its noncore activities and remains one of the leaders to follow.

As Mauritian business prepares itself to widen and deepen its footprint in Africa, the SS&O industry in Mauritius could be an important partner in ensuring success of mainstream business, provided companies go about their outsourcing strategy wisely.

In the next article, we shall consider the limitations of adopting a piecemeal strategy to SS&O.

BIBLIOGRAPHY

- Ferscht, Filippone, Aird, & Sappenfield. (2011). The Evolution of Global Business Services. PwC and HFS Research in collaboration with the London School of Economics Outsourcing Unit.

- Isaacson, W. (2011). Steve Jobs Biography.

- Johnson, Scholes & Whittington. (2006). Exploring Corporate Strategy 7th Edition. FT Prentice Hall.

- PwC Knowledge. (2012). http://pwcportal.pwcinternal.com/.

- Slack, Chambers, & Johnston. (2004). Operations Management, 4th Edition. FT Prentice Hall.