Euro-supportive comments by the ECB lifted growth assets

Share

The week started on a negative note with worries over escalating borrowing costs in Spain and Italy. More gloomy news emerged from Spain where regions, Murcia and Catalonia said they would seek government financial assistance. Spanish bonds hit another euro-era record past 7.5% and Italian bond yields moved towards 6.5%. In addition, rating agency Moody’s lowered its outlook for triple A-rated Germany, Netherlands and Luxembourg to negative, due to likelihood of Greek exit from the Eurozone. However, global markets finished the week in a bullish mood as European Central Bank (ECB) president Mario Draghi asserted that the Central Bank is ready to do whatever it takes to preserve the euro and is prepared to intervene in bond markets. Moreover, German Chancellor Angela Merkel and French President Francois Hollande released a joint statement on Friday saying they were determined to do Bloombergeverything possible to protect the Eurozone. On the equities front, Asian stocks ended mostly in red. The International Monetary Fund (IMF) warned that the worsening debt crisis in the Eurozone poses a key risk to China’s growth. The IMF said that it expects China’s economy to grow by 8% in the current financial year, but warned that a lack of response to the deteriorating crisis in the Eurozone, may cut that number by half. In Europe, equities ended in positive territory. Shares of Daimler gained 4.8% after Q2 sales rose by 10% to €28.9 billion. In US, the S&P 500 Index posted a weekly gain of 1.6%. Shares of Moody’s Corp rose by 10% to $39.74 after the world’s second-largest provider of credit ratings reported second-quarter profit that beat analyst estimates. However, shares of Facebook shed more than 10% as the company reported a Q2 loss of $157m compared with net income of $240m in the same quarter a year ago.

n

Gold Futures rallied above the $1,600 a troy ounce level last week on market talk that central banks in US and Europe will agree on bringing more liquidity to the markets which is supportive for gold. Fed Chairman Ben Bernanke already said that US policy makers are looking for ways to address the weakness in the economy should more action be needed to promote a sustained recovery in the labour market. In fact, gold has moved within a narrow range over the past few weeks, fluctuating on rising and falling expectations of quantitative easing in the US. The Fed’s policy-setting Open Market Committee two-day meeting started this Tuesday.

n

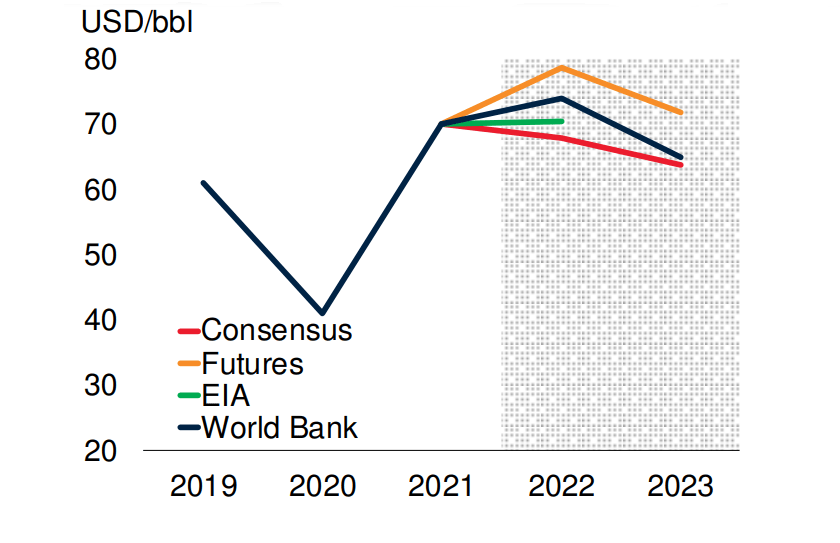

Crude Oil Futures ended the week near the US$90/bbl level as real gross domestic product, the output of goods and services produced by labour and property located in the United States, increased at an annual rate of 1.5% in the second quarter of 2012. The black gold gathered steam as first-time jobless claims fell to a four-year low and orders for US durable goods climbed more than expected in June which reduced concern that economic growth is slowing. Furthermore, the head of the European Central Bank pledged that the euro will survive. These bullish economic news lifted oil prices. Sugar Futures slid to 22.52 cents a pound last Friday.

nGraph – Dollar Index & Gold weekly price movements

n

The Euro climbed above the $1.22 level last week as the ECB president Draghi’s comments provided a knee-jerk bullish reaction for the shared currency. On July 25, a member of the European Central Bank’s Governing Council, Ewald Nowotny, claimed that there are arguments for giving Europe’s movementsnew permanent rescue fund a banking license enabling it to borrow unlimited central bank money to boost its capacity to rescue the likes of Spain, if required. The Euro pared gains after German manufacturing and services output contracted more than economists forecast in July.

n

Sterling weakened versus the US dollar as UK’s double-dip recession deepened sharply in Q2 2012. GDP saw a much deeper than expected 0.7% quarterly drop. Construction activity plunged 5.2%, production fell 1.3% and services declined 0.1%. Japanese finance minister Jun Azumi warned of currency intervention after the Yen extended gains versus the US dollar. According to Morgan Stanley, deflationary pressure building via falling import prices and weakening demand conditions suggest local monetary authorities will become increasingly yen-sensitive.

nBloombergAuthor: Dharmeshsingh Mohadewo

n(Senior Executive - Research and Product Development)

nGlobal Board of Trade Limited

n(Email Id: [email protected])