What does the Rupee have to do with triangles and channels?

Share

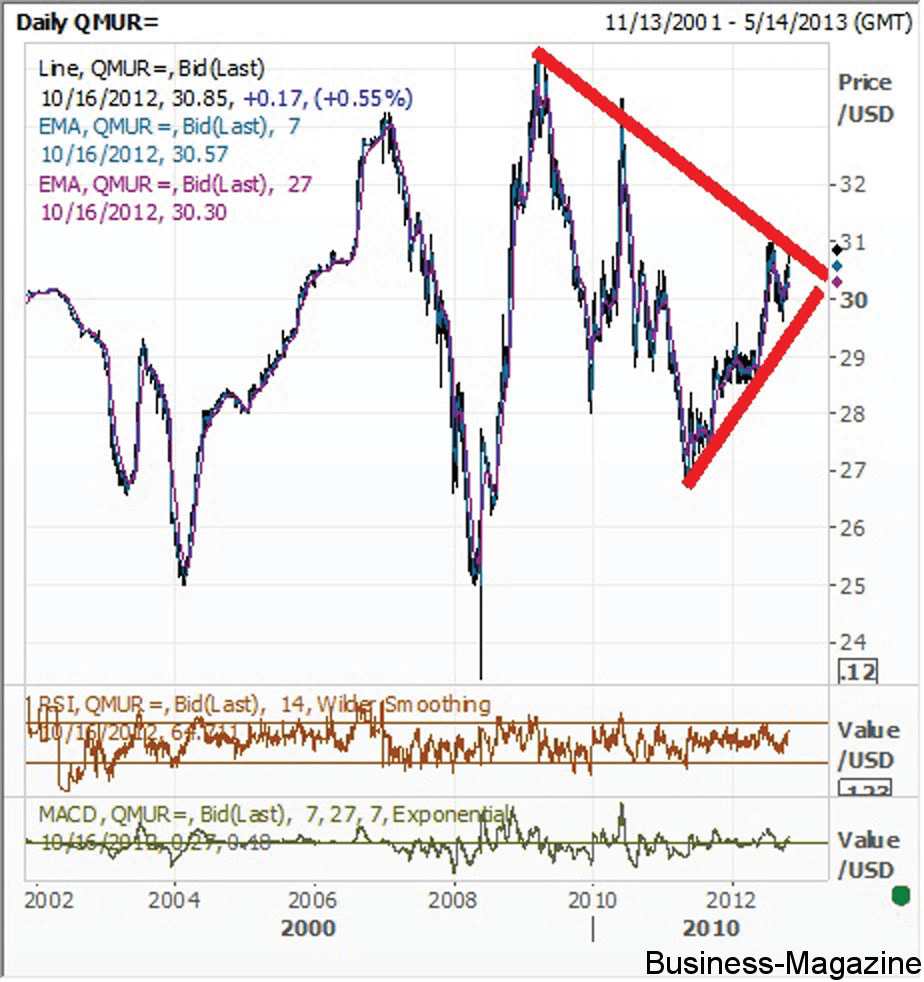

The Technical Voice has been bearish on the Rupee and on local equities not since this year but back when the local equity market topped and the Rupee was at multi year lows for there were too many bulls on local equities and on the Rupee. Where do we go from here then and what does the Rupee have to do with a triangle you may ask?

Chart patterns are magical for they tell you in an unbiased fashion where the market is and is not and where it is heading. We have been talking about the Rupee being engaged in a depreciating trend typified by the upward sloping lower trend line. As long as this line held, we remained bearish but there does come a time when trend lines meet and this convergence of major trend lines tends to be quite important indeed. The downward sloping trend line with is about to meet the upward sloping trend line in the coming months represents major resistance to further depreciation of the Rupee vs the USD. Considering the fact that the trend is and shall always remain your one true friend, it makes a world of sense to remain on the sidelines and let things play out up or down. Should the Rupee break above that resistance line or triangle, it would signal the continuation of a strong bear trend on the currency. In many ways, the reverse would be true should the Rupee convincingly break below the drawn triangular pattern. While many like to predict exact price targets, we like to go with the flow for going with the flow tends to make more money than astrological forecasts.

It is quite tempting to predict that the Rupee shall break above rather than below the triangle for our consistent outlook on the economy has always been for GDP growth of between 3 and 3.3% this year and between 2.8% and 3.4% next year with increased downside risks to that 2013 outlook. Real interest rates on the Rupee are furthermore no longer positive with savings yielding 3.5% with inflation expected to stabilize at the low to mid 4% range next year. Regardless of such temptations to short the Rupee, now is no longer the time to increase one’s short or long positions but to wait a bit longer for the market to figure itself out.

It is quite tempting to predict that the Rupee shall break above rather than below the triangle for our consistent outlook on the economy has always been for GDP growth of between 3 and 3.3% this year and between 2.8% and 3.4% next year with increased downside risks to that 2013 outlook. Real interest rates on the Rupee are furthermore no longer positive with savings yielding 3.5% with inflation expected to stabilize at the low to mid 4% range next year. Regardless of such temptations to short the Rupee, now is no longer the time to increase one’s short or long positions but to wait a bit longer for the market to figure itself out.

What many observers in the private sector may be more concerned about however may be the MUR/EUR cross which is currently engaged with some major resistance as part of the upper line of a downward sloping channel. Should the MUR/EUR fail to break above the drawn channel and stay above it, the Rupee would likely gain some strength vs the EUR in the coming months. However, should it move above, we believe this will benefit the local equity market.In many ways, being on the sidelines and waiting for some confirmation is again what needs to be followed with the MUR/EUR as well.

Is there a cross that in Rupee terms will make you some money in the meantime then? The CAD/MUR cross remains well in favor of further Rupee weakness despite the fact that some Canadian weakness may be coming temporarily. The bullish depreciating channel remains alive and kicking and weakness within the channel (as long as the channel holds) should be bought. Canada is one of the safest developed economies right now and is blessed with something Mauritius does not have, lots of real assets.

Is there a cross that in Rupee terms will make you some money in the meantime then? The CAD/MUR cross remains well in favor of further Rupee weakness despite the fact that some Canadian weakness may be coming temporarily. The bullish depreciating channel remains alive and kicking and weakness within the channel (as long as the channel holds) should be bought. Canada is one of the safest developed economies right now and is blessed with something Mauritius does not have, lots of real assets.

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.