Investors jittery about weak global growth and its impact on corporate profitability

Share

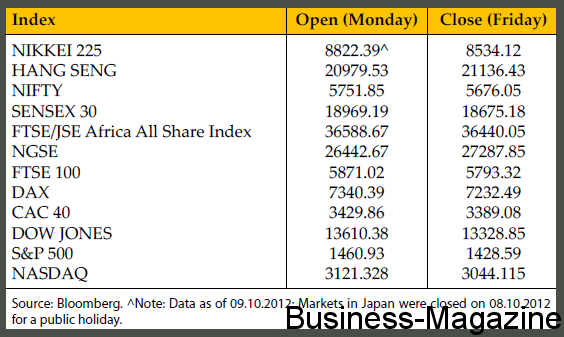

Trading was mixed across global asset classes in a generally bearish week. Investors remained jittery as they forecast a weak corporate earnings season after the International Monetary Fund purport that risks to global financial stability have increased in the past six months despite efforts by policymakers to make the financial system safer. The IMF downgraded its estimate for global growth in 2013 to 3.6% from the 3.9% it forecast in July. In addition, the World Bank cut its growth projections for the Asian region. The bank said that it expects China’s economy to grow by 7.7% in 2012, down from its projection of 8.2% in May. Adding to economic gloom, uncertainty remained regarding the timing of a possible bailout request by Spain. Many economists believe that an appeal by Spain for aid is all but inevitable. According to Barclays, if Spain delays requesting for help, market sentiment should gradually deteriorate. If Spain does make the request, it would at least remove uncertainty from the market. Further, Ratings agency Standard & Poor’s cut Spanish debt from BBB+ to BBB-, one level above junk status, and warned of possible further downgrades. The Spanish government said that the country’s overall debt levels will rise next year to more than 90% of total economic output. On the equities front, Germany’s DAX lost 2.2%, the UK’s FTSE 100 slid by 1.3% and France’s CAC 40 retreated by 2%. In Asia, equities traded in negative territory for most part of the week. Shares of Toyota Motor Corp (Asia’s largest carmaker by market value) shed 3.7% after reporting a significant drop in China sales. Singapore’s economy contracted by 1.5% in the July to September period. In US, the S&P 500 Index tumbled by 2.2% while the Dow Jones Industrial Average index fell by 2.1%. US stocks trimmed losses on Friday after JPMorgan Chase said that net income rose by 34% to $5.7bn in the third quarter.

GBOT Gold Futures finished a seesaw trading week on a lower note. Market participants lowered their holdings in gold on market talk that the Federal Reserve could scale down the size of its asset purchases amid signs that the US labour sector could be improving. The number of US workers who filed new applications for unemployment benefits dropped sharply by 30,000 last week to 339,000, the lowest level in more than four years. Furthermore, last Wednesday, the Fed released its Beige book which showed that the world’s largest economy expanded modestly last month. Gold also lost ground as concerns about the global economy prompted investors to sell the precious metal and take profit. The correlation between Gold and US dollar is depicted in the graph.

Crude Oil Futures pared advance on Friday as the International Energy Agency, the western countries’ energy watchdog, reduced its forecast of oil demand growth to 0.7m b/d for 2012 and kept unchanged its estimate for 2013 at 0.8m b/d. Thus, world oil demand will be 89.7 million barrels a day in 2012 and 90.5 million in 2013. Global oil demand is forecast to hit 95.7m b/d by 2017, up from an average of 89.8m b/d this year and equal to an average annual growth of 1.1m b/d. Crude Supplies will expand over the next five years by an aggregate 9.3m b/d to 102m b/d in 2017. Sugar Futures fell to 20.05 cents a pound last Friday.

Graph – Dollar Index & Gold weekly price movements

GBOT EUR/USD Futures fell to a week low of $1.2871 last Wednesday after Spain’s credit rating was cut by S&P to BBB-. Moreover, unemployment in Greece rose to a record 25.1% in July, with the level among young people reaching 54.2%. However, the Euro currency trimmed losses after the International Monetary Fund (IMF) head, Christine Lagarde, backed Greece by saying that the country can have more time to meet the targets of its bailout. Further, the Euro-area industrial production unexpectedly rose by 0.6% for a second month in August. Economists expected a decline of 0.4%.

GBOT GBP/USD Futures finished the week on a lower note as activity in the UK construction sector contracted by 11.6% in August, compared with the same month last year. The British Pound extended losses as the UK’s deficit on trade in goods and services widened to £4.2 billion in August, compared with a deficit of £1.7 billion in July. The South Africa’s rand weakened after Standard & Poor’s cut South Africa’s credit rating by one notch on Friday to BBB with a negative outlook.