Taking the Pulse of the Local Market

Share

Charts speak volumes of not only what has happened and what is happening but of what will happen as well. In inefficient markets technical analysis works wonders and remains an important tool if properly understood in order to better assess where the market is going. What we as investors are all concerned about on any given day is how much money we can make and perhaps more importantly how much money we can save by selling something that is about to fall or shall continue to fall. In general then, our aim is to limit the downside and maximize the upside so that the expected return of our strategy is positive.

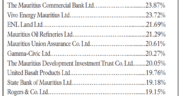

Where are the local market and its largest cap stock, the Mauritius Commercial Bank heading to as per the charts you may ask? First recall that the charts have been quite accurate so far in terms of predicting the downside, the key was and remains to understand and respect what they say. Looking at the chart of the SEMDEX, the index remains engaged in a downward sloping bearish channel and unless this trend is broken one way or another, remaining underweight equities remains what the chart is telling us to do. We can in fact use such channels along with more sophisticated systems to project that the market is likely to end the year between 1600 and 1700. While many may be tempted to buy into the market considering its fall of more than 9%, there is no BUY signal but indeed a SELL on strength signal as long as the channel is not breached to the upside on strong volume. In many ways, the chart also tells us that a multi-year bull market in Mauritius has ended and that while it is true that markets cannot go down forever, the good old days are over and we are due for a more modest future. We had a double top last year as the market failed to go well past its highs in 2008 and that we find bearish.

The second chart is perhaps more interesting as it gives us a simple outlook on the Mauritius Commercial Bank. For the past year, many have been selling hotel stocks and rotating their equity portfolio towards the most liquid stock on the exchange providing a sense of stability to the stock. The reality is that MCB too formed a double top which is certainly not bullish and still seems to have a lot of trouble going above Rs 170. While there is decent support so far at Rs 160 and then again at Rs 155, it remains too early to give a clear picture although the downside probabilities have been increasing while the upside probabilities have hence been falling. There is in sum no real risk asymmetry in buying such a stock at the moment. A break below the Rs 150-155 area would in general be quite bearish for the stock and the market in general as it would represent a more pronounced rotation out of local equities towards cash.

The second chart is perhaps more interesting as it gives us a simple outlook on the Mauritius Commercial Bank. For the past year, many have been selling hotel stocks and rotating their equity portfolio towards the most liquid stock on the exchange providing a sense of stability to the stock. The reality is that MCB too formed a double top which is certainly not bullish and still seems to have a lot of trouble going above Rs 170. While there is decent support so far at Rs 160 and then again at Rs 155, it remains too early to give a clear picture although the downside probabilities have been increasing while the upside probabilities have hence been falling. There is in sum no real risk asymmetry in buying such a stock at the moment. A break below the Rs 150-155 area would in general be quite bearish for the stock and the market in general as it would represent a more pronounced rotation out of local equities towards cash.

The global economy is slowing and so is Mauritius. In the meantime negative real interest rates have over time led to mal-investment and to a general deterioration in the balance sheets of many at risk sectors. With many banks already engaging in debt restructuring (soft defaults), credit growth to the corporate sector is likely to remain subdued in 2013. At the same time higher household indebtedness, the growth of which has surpassed nominal GDP growth by a substantial margin over the past six years in an environment of negative real interest rates presents risks to the retail side especially when most of this money has gone towards fueling an unsustainable real estate boom characterized by rental yields that are lower than long term fixed deposit rates and lower than the cost of debt (negative yield arbitrage).

The global economy is slowing and so is Mauritius. In the meantime negative real interest rates have over time led to mal-investment and to a general deterioration in the balance sheets of many at risk sectors. With many banks already engaging in debt restructuring (soft defaults), credit growth to the corporate sector is likely to remain subdued in 2013. At the same time higher household indebtedness, the growth of which has surpassed nominal GDP growth by a substantial margin over the past six years in an environment of negative real interest rates presents risks to the retail side especially when most of this money has gone towards fueling an unsustainable real estate boom characterized by rental yields that are lower than long term fixed deposit rates and lower than the cost of debt (negative yield arbitrage).

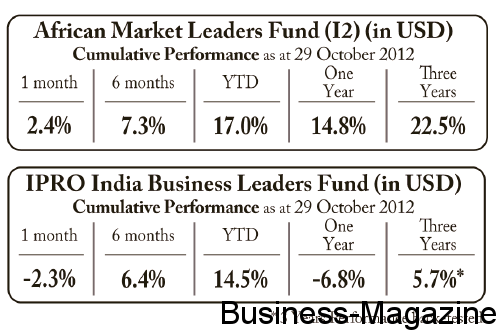

All of these fundamental factors are in a way reflected in the charts which point towards a more challenging future for fund managers who will need to become more dynamic and seek better alternatives to commercial real estate investments and to local equities within a diversified portfolio context.

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.