Global markets started the fourth quarter on the front foot US unemployment rate fell to 7.8 %

Share

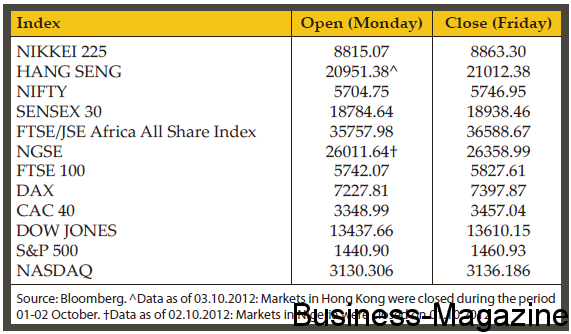

The global session has been mostly positive last week as market participants welcomed a US government jobs report showing solid job creation and an unexpected drop in the unemployment rate. US Nonfarm payrolls were reported at 114K in September. The unemployment rate came in at 7.8% versus the 8.2% consensus. Bullish sentiment in financial markets improved as the Institute for Supply Management showed new orders in the non-manufacturing sector gathered momentum. Furthermore, the US Mortgage Bankers Association’s index jumped by 16.6% in the period ended September 28 from the prior week. In line with optimism, the European Central Bank President Mario Draghi said that the common currency is irreversible and reiterates bond buying pledge. The European Central Bank (ECB) added that the central bank’s bond-buying plan, known as Outright Monetary Transactions (OMTs), will be used once government in the region asks for help. Furthermore, Spain successfully sold a total of €3.992 billion of short-term and medium-term government bonds, maturing in October 2014, October 2015 and July 2017, at the upper end of its €3 billion to €4 billion target range. Markets pared gains as the Euro-area jobless rate rose to a record 11.4% in August. On the equities front, European stocks posted their biggest weekly gain in a month. Germany’s DAX index rose by 2.5%, the UK’s FTSE 100 gained 2.3% while France’s CAC 40 increased by 3.1%. Asian equities also traded in positive territory last week. The S&P 500 Index wrapped up a 1.4% gain for the week. Shares of Netflix rose by 10.8% after Citigroup pointed to a survey which showed an improvement in customer satisfaction. Third-quarter earnings season kicks off this week.

Gold Futures swerved between losses and gains last week. The yellow metal climbed to a week high of $1,792.7 a troy ounce on Thursday following reassurance from the European Central Bank that it stood ready to buy Spain’s bonds if it requested aid. However, the precious metal lost some of its lustre on Friday after the US unemployment rate unexpectedly dropped, easing pressure on the Federal Reserve to expand monetary stimulus. Gold has gained around 11% in the third quarter, the most since June 2010, as the Federal Reserve announced a third round of US monetary stimulus. The correlation between Gold and US dollar is depicted in the graph.

Crude Oil Futures rose in early part of the week as investors remained wary about the violence in Syria spreading to neighbouring regions, which may lead to a disruption in Middle East oil supplies. Turkish parliament backed a measure to give the prime minister broad power to send troops into Syria. However, oil prices tumbled as the US Energy Department claimed that crude output has risen by 11,000 barrels a day to 6.52 million last week. In addition, total fuel demand slid by 0.3% to 18.3 million barrels a day in the four weeks ended September 28. Sugar Futures rose to 21.54 cents a pound last Friday.

GBOT EUR/USD Futures ended last week’s session above the $1.30 level after the ECB President Mario Draghi claimed that the Central Bank is ready to start buying government bonds as soon as the necessary conditions are fulfilled by any countries needing assistance. The Euro currency pared gains after a composite PMI of manufacturing and services industries in the Euro-area declined in September. Adding to concerns was speculation that Greece’s next aid tranche could be delayed.

GBOT GBP/USD Futures traded in a narrow range last week ending modestly higher. The UK construction PMI rose to 49.5 in September from 49 in August, according to Markit Economics and the Chartered Institute of Purchasing and Supply. Governor Mervyn King’s nine-member Monetary Policy Committee kept the bond-purchase target at £375 billion and left unchanged the key interest rate at 0.5%. The Japanese Yen trimmed losses versus the US dollar, supported by the Bank of Japan’s decision not to ease monetary policy despite pressure from Japan’s new economic and fiscal policy minister, Seiji Maehara.