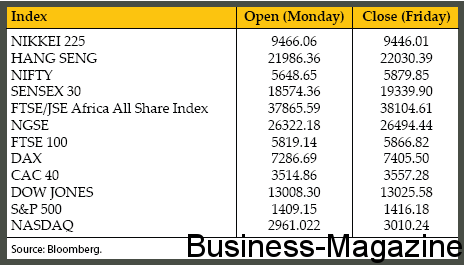

Markets witnessed a mixed performance during a volatile week

Share

Global markets saw a mixed performance last week. The US fiscal cliff debate, health of global economy coupled with the lingering Eurozone debt crisis took centre stage. Markets began the week on a positive note as the European Union, European Central Bank and the International Monetary Fund agreed to reduce Greece’s debts and release a long-delayed €34.4bn aid payment. However, the realization that any aid to Greece will still be subject to several parliamentary approvals, ongoing reforms and a successful debt buyback sapped confidence. In US, President Obama reiterated the importance of reaching compromise and expressed hope that enough Republicans can be convinced to vote in favour of his budget proposal before Christmas. However, House Speaker John Boehner said that there is a stalemate between Republicans and President Barack Obama’s administration. He said that Mr Obama’s proposal of $1.6 trillion in new tax revenue and less than $400 billion in spending cuts “was not serious”. On economic front, the Organisation for Economic Co-operation and Development lowered its growth forecasts across its 34 members for 2012 and 2013. The group’s economies will grow by 1.4% in 2013, rather than the 2.2% forecast in May. The Euro-area unemployment rate climbed to a record of 11.7% in October up from 11.6% the month before. In Spain, the jobless rate rose to 26.2% from 25.8% the previous month. In US, economic data releases were mixed. Consumer spending in the US fell by 0.2% in October, below the expected 0.1% uptick. However, the US economy grew at an annualised rate of 2.7% in Q3 2012 and initial jobless claims fell by 23,000 to a seasonally adjusted 393,000 in the week ended November 23. On the equities front, the S&P 500 Index rose by 0.5% while the Dow Jones Industrial Average advanced by 0.1% last week. European equities finished in green and Asian stocks posted a second weekly gain. Japan’s Nikkei 225 Stock Average gained 0.9%, its third weekly advance.

Gold Futures lost some of its lustre last week ending on a lower note at $1712.70/oz. Gold lost nearly $26 in a matter of minutes last Wednesday triggering a wave of technical selling. Market participants sold the precious metal to take profits given the degree of risk aversion in financial markets, amid Europe/Greece uncertainty and the US fiscal cliff. US Speaker John Boehner said that fiscal cliff talks with the White House have made no substantive progress during the last two weeks. In Europe, investors showed little enthusiasm about the Greek debt deal and European Central Bank president Mario Draghi said that the region would not exit its crisis until the latter half of next year.

WTI Crude Oil Futures gathered steam ending the month of November with a gain of about 3%. Geopolitical issues in the Middle East continue to support the oil market. The US Senate approved expanding the economic sanctions that have reduced Iran’s crude exports and earnings in a bid to force it to curb its suspected nuclear weapons program. In addition, signs of economic expansion in the US bolstered oil demand prospects. On a further note, output in the 12-member Organization of Petroleum Exporting Countries slipped by 333,000 barrels, to an average 31.519 million barrels a day in November (Bloomberg). Sugar Futures traded remained below the 20 cents a pound last week.

Graph – Dollar Index & Gold weekly price movements

The Euro currency inched above the $1.30 level last week as German parliament voted to ratify the Greek bailout deal and an index of executive and consumer sentiment in the Euro region increased to 85.7 in November from 84.3 in October. However, the confidence-sapping spectre of the Eurozone debt crisis resurfaced after Moody’s downgraded by one notch the ratings of the European Stability Mechanism (ESM) and those of the European Financial Stability Facility (ESFS). The move came in response to the recent downgrade of France to Aa1 from Aaa amid the high correlation in credit risk present among the ESFS’ and ESM’s entities’ largest financial supporters (France and Germany).

The British Pound traded above the $1.60 level last week. According to Research group, GfK NOP Ltd, UK consumer confidence unexpectedly increased to an 18-month high in November. Moreover, the UK economy grew by 1% in Q3 with consumer spending rising by 0.6%, the strongest rate for more than two years. The services sector grew by 1.3%.