Quelques membres de l’équipe de management de Floreal (de g. à d.) : Ajay Parsan, Factory Manager ; Neera Munisamy, Responsable des Opérations ; Max Liying, Design Manager ; Jean Baptiste De Spéville, CEO ; Veena Ghurburun, HR Manager ; Robert Nicollin, Q

Share

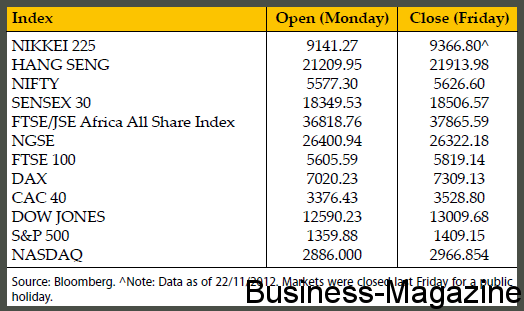

EQUITIES

Higher yielding assets extended gains last week buoyed by better than expected economic news from Germany and signs of progress that international creditors are edging towards a settlement with Greece. Euro-area finance ministers met early this week and reached a deal to overhaul Greece’s faltering bailout programme and release a long-delayed €34.4bn aid payment. German business confidence unexpectedly rose from a 2 1/2 year low in November while French industrial confidence climbed from a three-year low. Reports that Moody’s Investors Service has cut France’s sovereign rating to Aa1 from Aaa, failed to blunt market optimism. In US, the rally in risky assets was inspired by a broad risk-on mood across global financial markets, amid signs that US congressional leaders are making progress in striking a deal to avert the US fiscal cliff. Markets were also supported by encouraging news from the Middle East that Israel and Hamas have reached a cease-fire agreement. Improving outlook for Chinese and US economies also bolstered morale. Initial jobless claims dropped by 41,000 to 410,000 in the week ended November 17. Further, HSBC’s preliminary Chinese manufacturing index rose to 50.4 in November, from 49.5 in October, signalling expansion for the first time in 13 months in the world’s second-largest economy. A preliminary reading of the US manufacturing purchasing managers’ index from data group Markit showed a rise to 52.4 from a three-year low of 51 in October. On the equities front, European stocks clinched their biggest weekly rally in 2012 as UK’s FTSE 100 gained 3.8%, France’s CAC 40 added 5.6% and Germany’s DAX Index rose by 5.2%. In Asia, Japan’s Nikkei 225 Stock Average gained 3.8%, China’s Shanghai Composite Index climbed by 0.6% while Australia’s S&P/ASX 200 Index edged 1.8% higher. The Standard & Poor’s 500 Index finished a holiday-shortened trading week 3.6% higher.

COMMODITIES

Gold Futures rallied above $1,750/oz for the first time in more than a month last Friday amid US dollar weakness. Gold often falls on the dollar’s strength, but also tends to gain during times of uncertainty, as the precious metal is widely regarded as a store of wealth. The correlation between gold and dollar is depicted in the graph below. Central banks in emerging countries increased their gold holdings in the month of October, buying more than 40 metric tons of gold. Brazil raised its gold stocks by 17.170 metric tons to 52.5 metric tons. Furthermore, amount in exchange-traded products backed by gold rose to 2,606.3 metric tons on Friday.

WTI Crude Oil Futures gathered steam last week supported by upbeat economic data out of Germany, China and US which helped ease worries about oil demand prospects. Additionally, crude supplies dropped by 1.5 million barrels in the week ended November 16 to 374.5 million barrels, according to the US Energy Information Administration. Economists expected an increase of 1 million barrels. Sugar Futures traded in a narrow range closing modestly lower at 19.14 cents a pound last week.

Graph – Dollar Index & Gold weekly price movementsSource

CURRENCIES

The Euro currency rose to a three week high against the dollar last Friday, climbing above the $1.29 level. The German Federal Statistical Office showed that economic growth expanded by 0.2% in Q3 and Germany’s Ifo business climate index rose for the first time in seven months in November. The monthly survey of some 7,000 German firms published by the Munich-based Ifo institute rose to 101.4 in November from 100.0 in October. In addition, French industrial confidence improved in November. Further, on November 21, Germany sold €4 billion of 10-year bunds at an average yield of 1.40%, down from 1.56% at a previous sale on October 24.

GBOT GBP/USD Futures hit a week high of $1.6017 last Friday after a report from the British Banker Association (BBA) showed that mortgage approvals reach nine month high in October rising to 33,039. The data adds to evidence that the housing market activity is gaining momentum in the UK. Japanese Yen weakened versus the US dollar after the economy posted its largest trade deficit for October in more than 30 years - a trade deficit of ¥549 billion corresponding to US$6.7 billion. However, the Yen trimmed losses after the Bank of Japan’s policy board maintained its asset-purchasing programme at a total of ¥91tn ($1.1tn).