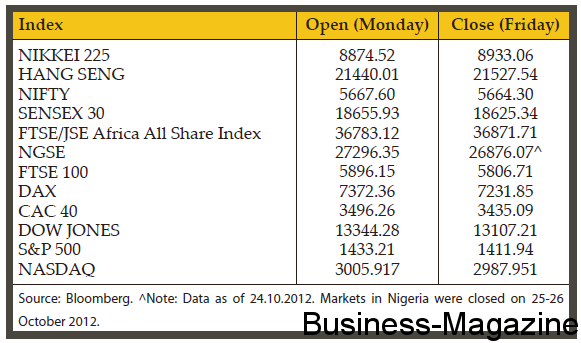

Risk aversion was the predominant theme in global markets

Share

The mood across asset classes was mildly risk off last week as markets traded mostly in negative territory amid uncertainty over corporate earnings coupled with Moody’s downgrade of five Spanish regions. Poor earnings outlooks from major companies such as Apple, South Korea’s Samsung, Renault and Ericsson in Europe offset better than expected US third-quarter economic growth and signs of improvement in China’s manufacturing activity. The latest disappointment in US came from Apple Inc as the iPad-maker reported that profit rose to $8.67 a share in the fiscal fourth quarter, below analysts’ estimates of $8.75 a share. Further, Caterpillar (the world’s biggest maker of construction and mining equipment) cut its profit forecast for 2012. It is now forecasting sales to be $66bn, down from an earlier estimate of between $68bn and $70bn. Moody’s Investors Service lowered the credit rating of Catalonia (which accounts for a fifth of Spain’s economy) by two steps to Ba3 from Ba1. Extremadura was lowered to Ba1 from Baa3, Andalucia was slashed to Ba2 from Baa3, and Castilla-La Mancha was cut to Ba3 from Ba2 and Murcia dropped to Ba3 from Ba1. Adding to the bearish sentiment, Spain’s jobless rate climbed to a record 25.02% in Q3 from 24.6% in Q2 while an index of Italian business confidence fell to 87.6 in October from 88.3 in September. On the equities front, the S&P 500 Index posted a weekly loss of 1.5%. Markets trimmed losses on news that the US economy grew by a 2% annual rate in the third quarter, up from 1.3% expansion in the second quarter. In Asia, equities closed mostly in red. South Korea’s Kospi Index tumbled as the country’s gross domestic product expanded by 1.6% in the three months to September from a year earlier, the slowest pace in three years. In Europe, Spanish banks dragged equities lower. Spanish lender Bankia reported a third-quarter loss of €2.6bn with total losses for the year reaching €7.05bn.

Gold Futures ended a volatile week on a lower note. The precious metal hit a week low of $1,700.2/oz last Wednesday as investors worried that the US Federal Reserve would adjust its policy statement in the wake of upbeat economic data, thus signalling a more hawkish stance on future monetary policy. The Central Bank reiterated its intention to keep interest rates near zero until mid-2015 and said it will continue with its programme to buy $40bn in mortgage-backed securities. The announcement lent some support to the yellow metal.

WTI Crude Oil Futures lost steam last week closing at $86.28/bbl. The US Energy Information Administration reported a 5.9 million barrel increase in crude supplies for the week ended October 19. Furthermore, lacklustre corporate earnings reports raised concerns about weakness in the global economy and its impact on demand for crude. Oil prices rose modestly this Monday amid concerns that Hurricane Sandy will disrupt East Coast refinery production in the US. Sugar Futures fell to 19.35 cents a pound last Friday.

Graph – Dollar Index & Gold weekly price movements

The biggest mover among currencies last week was the British Pound. GBOT GBP/USD Futures rose to a week high of $1.6130 as figures showed economic growth was much higher than expected in the third quarter of the year. The UK economy grew by 1% in Q3 2012, ahead of expectations of a 0.6% rise, according to the Office for National Statistics. Furthermore, the governor of the Bank of England, Mervyn King, said that the Bank stood ready to inject more money into the economy if needed.

The Euro currency swerved between modest gains and losses last week. The shared currency rose after consumers and businesses put money back into Spanish and Greek banks. Private sector deposits at Spanish banks rose to €1.505tn at end-September from €1.492tn a month earlier while Greek bank deposits rose to €160.1bn from €158.7bn. However, the Euro pared advance as German manufacturing growth contracted more than expected in October while the Ifo Business Climate Index for German industry fell to a two-and-a-half year low. GBOT EUR/USD Futures reflected this sentiment ending the week below the $1.30 level.