US budget fears and concerns about the health of global economy undermined sentiment

Share

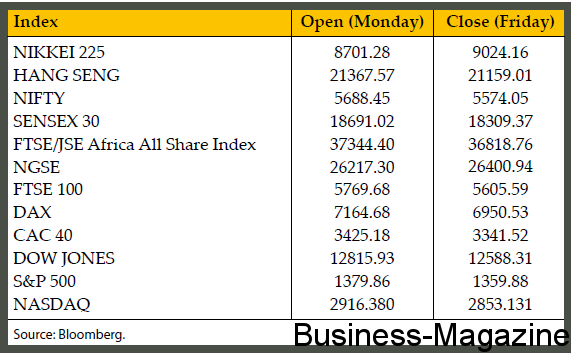

Most of the week’s focus was on the US fiscal cliff as President Barack Obama met congressional leaders in an attempt to avert a combination of tax hikes and spending cuts due to take effect in January 2013. Economists fear that without a compromise, the sharp fiscal tightening could eventually push the US economy back into recession. Around $607 billion of savings and tax rises are planned; including reductions in the defence budget, the end of an employee tax holiday, changes to Medicare allowances and higher personal taxes. After the meeting, the Republican speaker of the House of Representatives John Boehner claimed that his party is willing to consider increased revenue as long as it is accompanied by spending cuts. President Obama expressed optimism over an agreement with the congressional leaders to resolve fiscal challenges. Furthermore, concerns about general health of the economy and the pace of recovery are still weighing on investors’Bloombergconfidence. Economic data showed that the euro-area fell back into recession. GDP slipped by 0.1% in Q3 after a 0.2% decline in the previous three months. In addition, the Federal Reserve Bank of Philadelphia’s general economic index slid to minus 10.7 in November from 5.7 a month earlier. Applications for US initial jobless benefits surged by 78,000 to 439,000 in the week ended November 10. Moreover, Singapore said its GDP will grow by 1.5% in 2012, at the low end of its forecast while Japan’s government downgraded its assessment of the economy for a fourth month, saying that the economy may fall by 0.4% in Q4. On the equities front, Most European equities closed at three-month lows. France’s CAC 40 lost 2.4%, the UK’s FTSE 100 shed 2.8% and Germany’s DAX fell by 3%. In US, the S&P was down by 1.5% and the Dow Jones lost 1.8%, down for the fourth straight week. In Asia, the Shanghai Composite slid by 2.6%. Bad loans at Chinese banks rose by 22.4 billion yuan in Q3 to a total of 478.8 billion yuan.

Gold Futures displayed a volatile trend last week closing at $1,714.70/oz. The precious metal hit $1,730.10/oz last Wednesday after minutes of the October 23-24 US Federal Reserve’s policy meeting revealed support among the Fed’s policymakers to replace the “Operation Twist” bond-buying program, which ends in December, with long-term bond purchases. Gold Futures retreated by almost $16 last Thursday, after a World Gold Council report indicated that demand for the metal weakened by 11% in Q3 to 1,084.6 metric tons.

WTI Crude Oil Futures fluctuated last week. Oil prices dropped after the International Energy Agency cut its oil demand forecast for the last quarter of 2012 by 290,000 barrels a day to 90.1m b/d. Demand for 2012 would grow by 670,000 b/d – 60,000 b/d less than assumed last month. Further, oil stockpiles increased by 1.09 million to 375.9 million barrels in the week ended November 9. However, oil prices trimmed losses on concerns that tension between Israel and Hamas would jeopardise Middle East crude shipments. Sugar Futures was almost flat last week.

Graph – Dollar Index & Gold weekly price movements

The Euro currency continued its downward trend last week. GBOT EUR/USD Futures hit a week low of $1.2710 as economic data showed that Greece’s recession deepened in Q3 with gross domestic product falling by 7.2% from a year earlier. Further, Portugal’s economy also shrank for an eighth successive quarter, contracting by 0.8%. Additionally, industrial production in the region showed its steepest fall in more than three years in September, declining by 2.5% from August. The Euro trimmed losses after Germany successfully sold €4.3 billion of two-year bonds that paid no interest and Italy’s borrowing costs fell at a €3.5 billion sale of new three-year government bonds.

The British Pound seesawed between gains and losses last week. GBOT GBP/USD Futures rallied to a week high of $1.5899 last Wednesday after data showed that UK unemployment fell by 49,000 to 2.51 million in the three months to September, taking the jobless rate to 7.8% from 7.9%. However, the British Pound retreated after the Bank of England reported in its quarterly Inflation Report that it has cut its growth forecast for next year to about 1% from 2%, and added that recovery will be slow