US Fed could reduce the longevity of its QE3 programme

Share

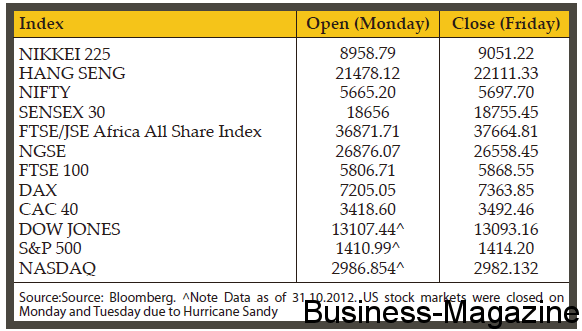

Global markets displayed a mixed performance last week. Major macroeconomic data out of US, China and Europe coupled with quarterly earnings reports from large companies caught investors’ focus. On the economic front, optimism was sparked by a stronger than forecast US jobs report which showed that a net 171,000 positions were created in the US and also extra 84,000 jobs were added in August. Furthermore, China’s manufacturing activity expanded for the first time in three months in October. The Purchasing Managers’ Index climbed to 50.2 in October from 49.8 in September. However, a survey by Markit (a leading global financial information services company) showed that the Eurozone’s manufacturing activity in October contracted for the 15th consecutive month. Market participants turned more cautious after the Court of Auditors, which vets Greek laws before they are submitted to parliament, ruled that planned pension cuts may be unconstitutional, throwing into Bloombergdoubt whether Greece can secure agreement with its lenders over bailout conditions. On the equities front, European stocks advanced last week as companies from BP Plc to Deutsche Bank AG reported earnings that topped analysts’ estimates. The bank reported that net revenues in Q3 rose to €8.7 billion compared to €7.3 billion same period a year ago, an increase of 18%. Moreover, BP Plc reported quarterly profit of $5.2 billion, a 40% increase on previous quarter. Germany’s DAX Index inched 1.8% higher, France’s CAC 40 rose by 1.7% and the UK’s FTSE 100 added 1.1%. Asian stocks posted weekly gains on signs that China’s economy may be stabilizing. Net income at Industrial & Commercial Bank of China Ltd rose by 15% to a record 62.4 billion Yuan. Liquidity was very light in US equities with the New York Stock Exchange closed last Monday and Tuesday due to Hurricane Sandy. Shares of Chevron Corp fell by 2.8% to $108.37, the biggest retreat in the Dow Jones Index as the company missed third-quarter earnings estimates; net income fell by 32.3%, while revenues dropped by 8.2%.

Gold Futures lost some of its shine last week losing $29.8 to mark their fourth weekly loss in a row. Robust jobs data from the US economy weighed on gold market sentiment. US data have all been better than expected recently raising speculation that the US Fed could eventually reduce the longevity of the Federal Reserve’s third round of quantitative easing programme. Further, expectations increased that the Fed would not pump in additional liquidity once the Operation Twist programme ends in December as the economy continues to show signs of strength. As a matter of fact, this led to sharp rally in the US Dollar against major trading currencies, in turn leading to a sharp sell-off in commodities. The correlation between Gold and US dollar is depicted in the graph.

WTI Crude Oil Futures lost some of its steam last week clos-ing below the $85/bbl level as investors remained jittery over energy demand in the aftermath of storm Sandy. Moreover, the American Petroleum Institute (API) reported that US oil stock-piles rose by 2.1 million barrels to 371.7 million last week. The industry-funded API collects stockpile in-formation on a voluntary basis from op-erators of re-fineries, bulk terminals and pipelines. Fur-ther, economic data releases were mixed: US jobs report was better than ex-pected but the Euro-area man-ufacturing output contracted in October, adding to signs of a recession in the region. Sugar Futures traded below the 20 cents a pound last week.

Graph – Dollar Index & Gold weekly price movements

The Euro currency struggled ending the week below the $1.29 amid lacklustre economic data from the Eurozone. Unemployment in the Eurozone region rose to 11.6% in September from 11.5% in August while Spanish retail sales fell by 10.9% in the same month from a year ago. Furthermore, Greece’s manufacturing sector shrank again in October and the country’s government announced budget projections that were worse than predicted. Greece’s debt will hit 189% of GDP in 2013 and climb to 192% in 2014.

The British Pound fluctuated last week to close modestly lower at $1.6058 on Friday as UK consumer confidence fell to a six-month low in October, according to the leading market research agency, GfK NOP. However, the currency unit pared losses after the realized distributive trades in the UK jumped by 30% in October following a survey conducted by the Confederation British Industry. Japanese Yen weakened versus the US dollar as the Bank of Japan increased its monetary stimulus by ¥11 trillion to ¥91 trillion.