Rising to the challenges of a world in transition

Share

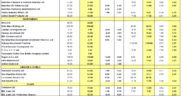

Although there were some areas designed to raise revenues, most notably changes made to rates of excise duties on alcoholic drinks and cigarettes, with no major incentives announced for the main sectors of the economy such as the tourism industry, it is hard to see how the growth projection of 4% for 2013 will be achieved. The forecast drop of Discounted Public sector debt/GDP ratio from 54.2% in 2012 to 53.7% in 2013 might also be a challenge.

Supporting higher growth

Mauritius has maintained a good level of resilience with a growth rate of 3.4% in line with the forecast of the International Monetary Fund (IMF) despite its vulnerability and dependency on international economic conditions (particularly Europe). Nevertheless with international conditions not favourable, the expectations of economic operators were on the Finance Minister’s steps to promote investment in infrastructure and other business facilitation reforms. Although some fiscal incentives have been re-introduced in the form of accelerated depreciation of 50% for the manufacturing sector, some sectors like the tourism industry have not benefitted from material incentives.

Fighting unemployment and job creation

Unemployment remaining constant at 8% this year, creating jobs (particularly amongst the youth) has rapidly become high priority. The Minister’s fourpoint action plan to address youth unemployment should provide a boost to this sector through the injection of Rs330m.

Diversification of our economic base

The Finance Minister is taking strong initiatives to encourage economic development by tapping into the potential of Africa. Freeport status will be granted to companies wishing to carry out specific manufacturing activities entirely for export to Africa. Moreover, visas have been removed and it is anticipated that more DTAAs will be signed with African countries.

The government also plans to bolster development by addressing traditional areas such as ICT, Financial Services and SMEs.

This budget goes a long way towards building up the IT capability of the nation, supporting the vision of strengthening one of the strong pillars of the Mauritian economy. In this context, the budget provides for a reduction in internet costs, online IT training system, wider use of wireless technology and the distribution of one tablet computer to each student of form IV upon a nominal payment of Rs.500.

The Government has also taken the initiative to improve and diversify the financial services sector by presenting a Limited Liability Partnership bill and also amending the Securities Regulation 2008 to allow the setting up of Special Purpose Funds for conducting investments in Mauritius.

The budget has benefitted SMEs by capping interest rates, rationalising bank charges and taxes and minimising the tax burden through the increase in the VAT registration threshold from Rs.2m to Rs.4m.

Controlling costs

The Finance Minister is to be commended for his efforts towards controlling costs in the Public Sector. This area has been repeatedly picked up in successive audits and finally measures have been introduced to address this. Amongst the measures included, a Public Task Force will be introduced to review public sector expenditure and additional resources will be made available to the Director of Audit in the form of 19 additional Examiners of Accounts.