Can the Nigerian Bank Rally Last?

Share

Sub Saharan Africa like all frontier market regions remains one of the most inefficient markets out there. While accounting standards and transparency in general are quickly improving and in some cases even converging to global standards, there is still a lot of room for improvement out there. Inefficiency of course is nothing technical and fundamental analysts cannot handle for these are the markets where quick profits can be made more easily.

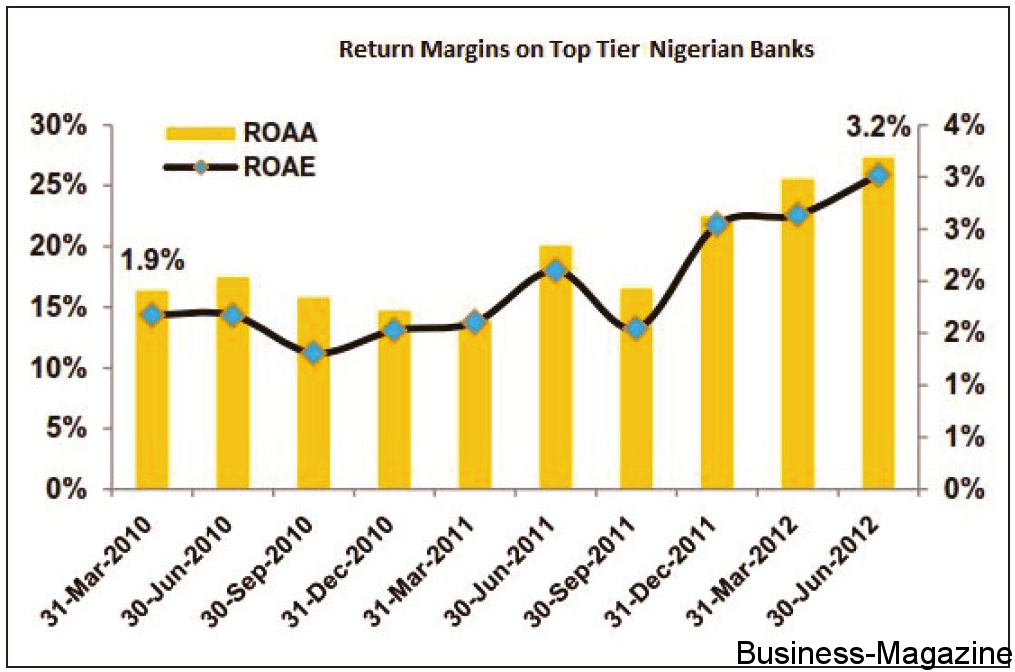

The best risk on trade in Africa this year has been within the Nigerian and Kenyan large cap banking space. Not only were these stocks the most liquid anyway but they had been lagging market benchmarks for years while margins were finally bottoming out and recovering. Nigerian banks have been enjoying a bull market in 2012 not seen since the 2006-2008 banking bubble period with top tier banks gaining between 35% in USD terms to 75% this year. The key question is, can the rally really last?

First, foreigners have been engaged in a globally sourced risk on trade buying high yielding African debt and cheap Nigerian banks and continue to be the biggest players in sustaining the rally. The key then is to have an opinion on the global risk on rally. Nigeria, being one of the most liquid markets in Africa tends to be one of the first places to feel risk off and because Africa tends to get money well after foreigners have bought into the more liquid and known markets of the world, it tends to be one of the last places to feel risk on (although less liquid African markets come in much later). As long as western central banks continue to print money with such things as unlimited QE however, money will continue to chase cheap valuations and the cheapest valuations on the planet and highest growth tends to be in Africa. The only risk to the inflation outlook which had been improving in 2012 (which is why bond yields have been compressing) is the secular bull market that appears to be forming in the soft commodities space globally. Higher food prices could temporarily at least prevent further bond yield compression in Africa and make foreigners more neutral than bullish but we suspect that valuations are cheap enough that interest shall again build at lower levels.

Secondly, credit growth to the private sector in Nigeria has been slowing since December with the YTD growth pegged at a mere 4.7%. Banks are constantly complaining about the lack of quality projects to fund in the private sector and with Government bond yields in the mid-teens, the private sector has been crowded out. This means that banks’ earnings coming from their core lending business is currently slowing down. Net profit margins of the top tier banks too appear to be stabilizing now and with the topline run rate moderating in the coming quarters, net profit margins have likely seen a good chunk of their recovery already.

2011 was such an interesting year of restructuring and recapitalization that the year on year growth rates look high but 2013 shall be set on a higher 2012 base. Base effects aside however, the inflation outlook is slowly but surely improving with inflation expected to fall towards the upper single digits (renewed food price pressures in 2013 likely) in early 2013, credit growth is expected to pick up somewhat as Government bond yields at the long end of the curve compress by an expected 140-200bps. The lack of further yield compression beyond this and an uncertain global climate will likely mean that the best part of the Nigerian top tier banking rally is behind us.

On a Sub Saharan Africa valuation perspective, the likes of FirstBank, Zenith and to a lesser extend Guaranty Trust Bank are still cheap for while the rally in the stock price was massive in 2012, it was also followed by a substantial increase in earnings. The reality is that when a FirstBank is slowing down in 2013, its growth in earnings shall still be in the upper teens paying you a dividend yield of 8.6% trading at 1.16x book. Ratings agencies such as S&P have constantly argued that because this is Africa, the way they calculate risk weighted assets is different and hence actual capital adequacy ratios (CARs) are lower than official figures but we focus a lot on dividend yields and the percentage of liquid assets to total assets in Africa and they give us some comfort indeed for things are clearly improving.

The fact that valuations are still cheap, NPLs at less than 4% means that downside risks in a post recapitalized Nigerian banking space are not as high as the longer term potential. We hence suspect that while the technicals are stretched at current levels and a correction is overdue, the buying on the dips mentality and the gradual higher participation of locals (who were scared away into the high yielding bond market in 2010-2011) shall cushion the downside. On an Africa wide perspective, we would still prefer to diversity into countries like Rwanda and Ghana for less people know about these gems and have bought these shares. The trick about inefficient markets is that when everyone and their mother become bullish, despite the still strong fundamentals, a correction is coming. The solution in a continent where dips can take a toll of 10-20% on a stock is to play it smart by not buying right now and waiting for the fall. This is particularly true when the global economy is slowing down.

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.