Senegal’s Sonatel : the less risky way to play Africa

Share

Beyond the global news headlines which almost always focus on the wars and corruption, Africa, while risky does have its story to tell. One of the best ways to invest in the continent is not only to focus on the consumer, infrastructure and retail banking space but within these themes, to focus on companies that have near monopolistic attributes. Not only do near monopolies have stable free cash flows but in a continent where corporations and politicians are often bed side fellows, over the longer term the operating environment ends up as being favorable to them.

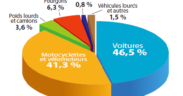

With a market cap of close to 2.2Bn USD, West African telecoms giant Sonatel is by far the largest cap stock in La Bourse Regionale des Valeurs Mobilieres(BRVM). The telecoms giant is the principal telecommunications provider of Senegal and is active in fixed line telephony, mobile telephony, internet/data services, television and corporate communications. In terms of market share, Sonatel controls 64% of the telecom market in Senegal, 59% of the troubled Mali market and is the second largest operator in both Bissau and Guinea.

Sonatel being a near monopoly is a strong generator of free cash flows. Its dominance in its four key markets allows it to generate EBITDA margins in excess of 50% on a regular basis. Strong free cash flow generation also means that the stock is trading at a forward dividend yield of 12.6%, one of the highest in the Sub Saharan blue chip space.

Sonatel is certainly not a high growth company with management guiding on topline growth of between 3-5% for the next three years which is not that bad considering current political turmoil in Mali. However, it is important to understand that while West African economies like Senegal, Bissau and Guinea may not be growing as fast as the likes of Nigeria, their inflation rates are some of the lowest in Africa hovering at around the low single digit mark.

In any event, while growth in Sonatel’s subscriber base in the fixed line segment has slowed dramatically in the region over the years, mobile telephony growth along with related data services continues to do quite well. Only about 6% of mobile subscribers in the region also use mobile internet today. Sonatel has also invested heavily over the years in the West African undersea cable connecting Europe to the continent which will position it as the unquestionable leader in data services.

When such high EBITDA margins are generated of course, competition can over the longer term become a problem. Sonatel in fact has been trying to fight back at the low end segment in Senegal and has so far done a good job at cornering Tigo but at a cost when it comes to its Average Rate Per Unit (ARPU). When it comes to Mali which accounts for 30% of total revenues, the coming of a third operator this year had already led to strong discounting way back in 2010 and considering the current political situation in the country, Mali remains an important risk factor. Sonatel is in any event focusing on Guinea and Bissau for future growth with an aim to become the number one operator by 2017.

In terms of the company’s ability to maintain EBITDA margins above 50%, it has already committed to a 7Bn CFA cost cutting program this year and is investing heavily in much cheaper hybrid base stations which combine both solar and traditional energy sources.

In sum then, Sonatel provides an entry point into a near monopoly trading at 3.3x forward EV/EBITDA, having strong free cash flow yields, little debt and the currency risk is somewhat mitigated for European investors as well. Unfavorable tax regulations and competitive pressures had caused growth and margin pressure in 2011 leading to disappointing earnings and a selloff in the stock price but 2012 remains encouraging despite the situation in Mali. While Mali has likely frozen any potential rally in the short term, the valuations are now attractive because of it. With such a decent dividend yield to pay us to wait in the meantime, we remain convinced that Sonatel, despite its elephant growth rate has decent gains for long term investors looking for a less risky way to play Africa.

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.