The confidence-sapping spectre of US “Fiscal Cliff” weighed on sentiment

Share

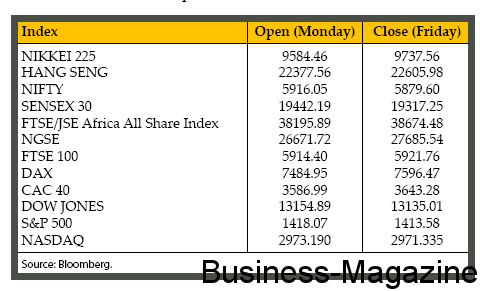

Global markets witnessed a mixed performance last week. In US, the lack of tangible progress on the budget negotiations overshadowed the Federal Reserve’s plan to expand bond purchases and some upbeat economic data. Last Wednesday, the Federal Open Market Committee held its Federal Funds Rate steady at 0-0.25% and announced that the ‘Operation Twist’ will be replaced by a Treasury purchasing programme with an initial rate of $45 billion per month. Furthermore, the key interest rate is expected to remain at exceptionally low levels until a target unemployment rate of 6.5% is reached. Retail sales and industrial output rose in November while the Markit Flash US Manufacturing Purchasing Managers’ Index rose to 54.2 in December from 52.8 in November. However, the confidence-sapping spectre of the US “Fiscal Cliff” weighed on sentiment. The S&P Index lost 0.3%. In Europe, the bullish sentiment was underpinned by the agreement of European Union finance ministers to put the European Central Bank in charge of up to 200 Eurozone lenders from early 2014. The finance ministers approved a €49.1 billion payment of aid to Greece after the country completed a buyback of its own debt. However, risk appetite waned after Italian Prime Minister Mario Monti said that he will step down when the country’s 2013 budget passes into law. Additionally, Standard & Poor’s became the last of the three main rating agencies to put the UK’s top AAA rating on “negative outlook”. China’s Shanghai Composite Index gained 4.3% last Friday, following stronger than expected manufacturing data. HSBC’s preliminary version of its December manufacturing Purchasing Managers’ Index survey rose to a 14-month high. India’s Sensex trimmed losses after a slower than expected 7.24% rise in wholesale prices, which helped inflation-sensitive stocks such as property and banks.

Gold Futures finished a seesaw week below $1,700/oz. The precious metal hit a week high of $1,725/oz last Wednesday as the US Federal Reserve announced a new bond-buying programme that led to further losses in the dollar, providing a lift to dollar-denominated commodities. However, gold retreated by end of the week due to short-side profit-taking and on stronger-than expected manufacturing data from China and US. In addition, gold lost ground as a store of value after US consumer prices fell for the first time in six months to 1.8% (YoY) in November. The correlation between Gold and US dollar is seen in the graph.

WTI Crude Oil Futures gathered steam last week. The International Energy Agency increased its oil demand forecast for 2013. Global oil consumption will expand to 90.5 million barrels a day next year. Moreover, the Organization of the Petroleum Exporting Countries (OPEC) left its production ceiling unchanged at 30m barrels a day, and the US Federal Reserve announced a new bond-buying programme. A weaker US dollar and ongoing violence in Syria (which fuelled concerns over oil supplies from the Middle East) lent support to oil prices. Sugar Futures slid to 19.01 cents a pound last week. Unica, the Brazilian industry association reported that production of sugar in the main south and central region rose by 6% to 32.9m tonnes in November from a year before.

Graph – Dollar Index & Gold weekly price movements

The Euro currency finished the last trading session of the week on a higher note, posting a weekly gain of 1.7%. The Euro was buoyed by data showing that the preliminary reading of Germany’s purchasing managers’ composite output index has risen to 50.5 in December from 49.2 in November. In addition, Euro-area services and manufacturing output contracted at a slower pace than economists’ forecast in December. The ZEW Centre for European Economic Research in Mannheim showed that German investor confidence improved in December. On a further note, Fitch rating agency maintained French’s AAA credit rating.

GBOT GBP/USD Futures rallied last week to close above the $1.61 level as the number of people out of work in the UK fell by 82,000 between August and October, to 2.51 million. The number of people claiming Jobseeker’s Allowance in the UK fell by 3,000 to 1.58 million in November. Unemployment rate came in at 7.8%. The British Pound pared advance after rating agency Standard & Poor’s (S&P) put the UK’s top AAA rating on “negative outlook” and revised its outlook on the Bank of England’s AAA rating to negative.