Global growth concerns and political jostling in US kept sentiment in check

Share

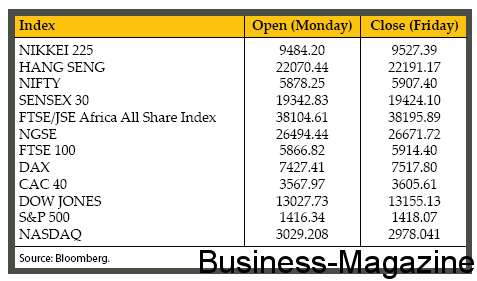

Sentiment across global markets remained mixed last week as lingering uncertainty over the US fiscal cliff coupled with developments in Eurozone took centre stage. Week began on a positive note with bullish sentiment supported by upbeat China’s manufacturing activity. Furthermore, Greece started its bond buyback to cut its heavy debt, offering to buy back as much as €10bn ($13bn) in debt. An element of uncertainty was removed in the markets after European finance ministers agreed €39.5bn aid for Spain’s banks. However, most of the major equities and commodities gave up a large portion of their initial gains after European Central bank (ECB) revised the GDP growth projections for the Eurozone downwards to -0.6% and -0.4% for 2012, between -0.9% and 0.3% for 2013. S&P lowered Greece’s long term credit rating to ‘Select Default’ from ‘CCC’ and Germany’s Central Bank, Bundesbank, slashed its forecast for the country’s GDP expansion in 2013, from an early estimate of 1.6% to just 0.4%. Additionally, US President Obama’s administration rejected a Republican plan for tackling the fiscal cliff that omitted higher tax rates for top-earning Americans. On the equities front, Asian stocks rose for a third week. Australia’s S&P/ASX 200 gained 1% as the central bank cut its benchmark interest rate to 3% while South Korea’s Kospi Index climbed by 1.3% after economy grew by 0.1% in Q3 from the previous three months. European equities finished modestly higher; France’s CAC gained 0.1% and UK’s FTSE 100 rose by 0.2%. US stocks rallied, sending the S&P’s 500 Index higher for a third week. Non-farm payrolls data showed 146,000 jobs were created in the US in Nov, beating economists’ expectations of 85,000. Financial sector stocks were the week’s best performing sector, as major banks recorded strong gains. Shares of JPMorgan Chase gained 3.6% to $42.56, while Bank of America rose by 7.9% to $10.64.

Gold Futures fluctuated last week. The precious metal had a difficult session falling below $1,700/oz last Tuesday after previous support levels were breached, triggering a flurry of selling. Investors seemed more cautious about gold’s short-term direction after its recent lacklustre performance. However, the precious metal bounced back as from Wednesday on market talk that the US Federal Reserve will announce additional asset purchases at its meeting this Wednesday as a replacement for “operation twist”. Previous rounds of asset purchases, known as quantitative easing, have supported gold. During a volatile session on Friday, gold initially weakened after upbeat US jobs data, but it then changed direction to settle higher.

WTI Crude Oil Futures dropped amid a bleaker outlook for oil demand with US struggling to find a solution to the so-called “fiscal cliff” and further weakness in the Euro zone. Nevertheless, according to Deutsche Bank AG, oil consumption in China, the world’s second-largest crude user after the US, may expand by 3.4% next year amid refinery expansions and additions to strategic reserves. Sugar Futures finished last week’s session on a lower note. World sugar supplies may exceed demand by 5.364 million metric tons in the 2012-13 season, according to Morgan Stanley.

Graph – Dollar Index & Gold weekly price movements

GBOT EUR/USD Futures hit a week low of $1.2887 on Friday after Bundesbank, Germany’s central bank, said it expects economic growth of just 0.4% in the Eurozone’s largest economy next year. The austerity drive across the Eurozone is affecting the German economy as construction activity and production of investment goods declined. Industrial production fell by 2.6% in October and was down by 3.6% year on year. Moreover, the Euro zone’s economy shrank by 0.1% in Q3 from Q2, when it contracted by 0.2% while France’s unemployment rate rose to 10.3% in Q3 from 10.2% in Q2.

GBOT GBP/USD Futures traded in a narrow range last week. British Pound rose versus the US dollar after the British Chambers of Commerce increased its forecast for UK growth for 2012; the economy will shrink by 0.1% this year, less than the 0.4% contraction it had predicted previously. However, the currency retreated to end the week on a lower note as UK manufacturing output fell by 1.3% in October. Further, the Fitch ratings agency said that UK’s failure to meet a key public debt target weakens the credibility of its top AAA credit rating.