Global growth worries and Spain’s fiscal position weighed on investors’ mood

Share

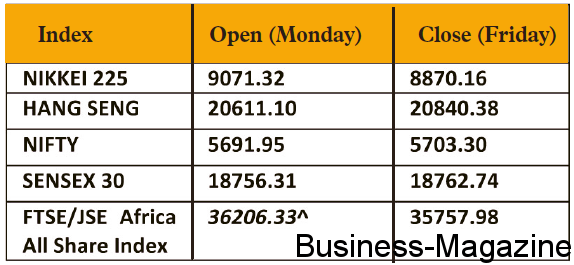

Markets’ notable rise in risk aversion last week was due to anti-austerity demonstrations in Spain and Greece which reminded political difficulties facing European governments as they seek to reduce budget deficits. Yields on Spain 10-year bonds hit 6% on worries about the country’s commitment to put reforms in place due to violent protests by the Catalonia region. In fact, the region has called earlier elections for November 25, which will be seen effective as a referendum on Catalan independence and thus could jeopardise plans for national economic reforms. Furthermore, global growth worries weighed on investors’ mood as the Ifo Institute’s main business climate index, which questions executives at 7,000 German companies, fell for the fifth successive month to 101.4 in September, its lowest reading since February 2010. Sales of new US homes declined in August while the number of unemployed people in France topped 3 million for the first time since 1999. However, markets trimmed losses on the last two days of the week as Spain announced its 2013 budget on September 27 which included spending cuts and no tax hikes. Prime Minister Mariano Rajoy vowed to cut the deficit by at least €18 billion next year. On the equities front, European stocks posted their biggest weekly decline since June. France’s CAC 40 Index shed 5%, the UK’s FTSE 100 Index fell by 1.9%, and Germany’s DAX Index retreated by 3.2%. US equities capped their biggest weekly slump since June as the third estimate of US second quarter GDP indicated growth of 1.3%, well below the prior reading of 1.7%. Further, new orders of durable goods fell by 13.2% during August. Asian equities traded in negative territory last week. Japan’s industrial output fell by 1.3% from the previous month, and by 4.3% compared to a year earlier. Chinese industrial companies’ profits dropped for a fifth month in August with net income falling by 6.2% from a year earlier to 381.2 billion Yuan ($60.4 billion).

Gold Futures seesawed between gains and losses last week. The precious metal fell to a week low of $1,742.9/oz last Wednesday, hit by heightened risk aversion due to renewed concerns about the Euro zone’s debt crisis. The dollar has been trumping gold as the safest haven mainly because of liquidity in times of uncertainty. However, the precious metal pared losses as unrest in South Africa’s gold mines introduced some supply fears to the market. The correlation between the US dollar and the gold is depicted in the graph below.

Commodities Futures

Crude oil prices failed to gain momentum last week amid renewed concerns that the worsening European crisis will reduce consumption. The US Energy Department claimed that the total US fuel use has fallen by 1.1% to 18.4 million barrels a day in the four weeks ended September 21. Lacklustre macroeconomic data also weighed on oil demand prospects. A fall of 2.45 million barrels to 365.2 million in crude inventories last week failed to lift the black gold. Sugar Futures rose to 20.42 cents a pound last Friday.

The Euro currency weakened against the US dollar last week as political uncertainty in Spain and a general strike in Greece over new policies to tackle the debt crisis were put back in the spotlight. According to Spain’s Treasury Minister Cristobal Montoro, debt would likely reach 85.3% of the Spain’s annual economic output in 2012, increasing to 90.5% in 2013. The Euro currency extended losses after the Euro-area economic confidence unexpectedly fell in September. An index of executive and consumer sentiment in the region dropped to 85 from 86.1 in August. Further, Spanish retail sales fell by 2.1% in August from a year earlier.

Currencies Futures

GBOT GBP/USD Futures slid last week to end at $1.6137 as UK’s economic growth contracted by 0.4% in the second quarter from the first, according to the Office for National Statistics. Sterling trimmed losses after the London-based research group GfK NOP Ltd showed that an index of UK’s consumer confidence rose by one point in September from August to minus 28, a 15-month high. Moreover, UK service sector bounced back in July, raising hopes of an economic recovery in Q3 2012.