Global investors fretted about the global economic outlook

Share

Market participants fretted about the global economic outlook last week. Spain’s budget minister Cristobal Montoro claimed that gross domestic product of the Eurozone’s fourth-largest economy is now likely to contract by around 0.5% in 2013, compared to a previous forecast of 0.2% growth. The Spanish government also downgraded its forecast for 2014 growth, to 1.2% from a previous figure of 1.4%. Adding to economic gloom, the International Monetary Fund downgraded its forecast for 2013 global growth to 3.9% from the 4.1% prediction it made in April. Investors turned bearish amid the sustainability of high borrowing costs in the Eurozone. Spain’s 10-year yields moved back above the 7% level, up by 27 basis points to 7.28% on Friday after the regional authority of Valencia claimed that it needs help from the central government exacerbating concerns over Spain’s ability to avoid a full bailout. In the US, the much awaited US Federal Reserve Chairman Ben Bernanke’s two-day testimony to congress disappointed global investors as he offered no direct hints regarding quantitative easing phase 3 (QE3). However, the downside was limited after Bernanke said that further deterioration in the labour sector could warrant additional easing. On the equities front, the S&P 500 index capped the biggest drop in 1 Month last week. Goldman Sachs Group Inc said that net profit in Q2 was $962m on net revenues of $6.63bn, compared with $1.08bn on revenues of $7.28bn in the same period last year. European stocks tumbled last week on concerns that the Euro area debt crisis is deepening. Shares of Vodafone Group Plc fell after the company reported a worse-than forecast drop in quarterly revenue to $16.9 billion. Asian equities ended mixed last week. Hong Kong’s Hang Seng Index gained 2.9%, while China’s Shanghai Composite Index slid by 0.8%.

n

n

Gold Futures seesawed between gains and losses last week, the main driver being US Federal Reserve chairman Bernanke’s testimony before Congress. Gold lost its lustre as Mr Bernanke failed to offer any specific references to further quantitative easing. Talks of monetary easing are positive for gold, which traditionally thrives on fears of inflation and currency debasement. Gold retreated as a store of value after US consumer prices came in flat in June and Indian inflation rate fell to 10.02% in June as against 10.36% in May. However, Gold gained from some safe haven flows last Friday as yields on Spain’s benchmark bonds climbed well above the critical 7% level.

n

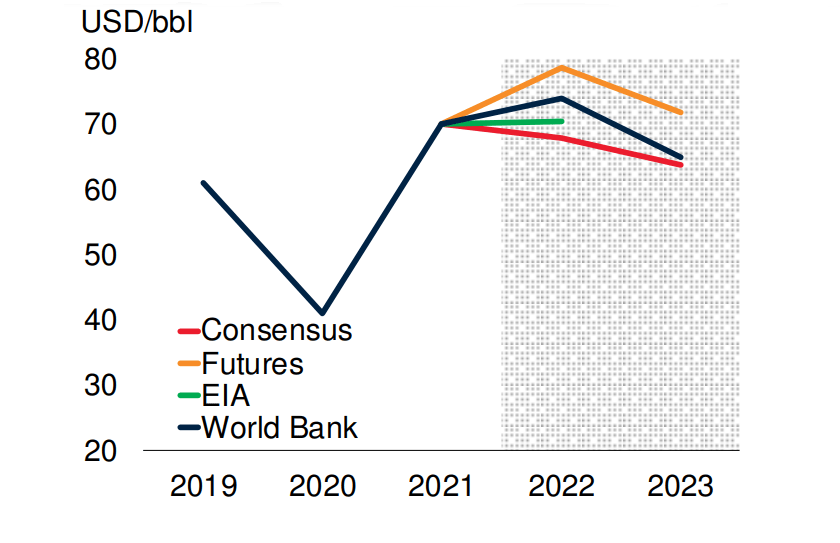

Crude Oil Futures rallied above the $91/bbl last week. The US Energy Information Administration reported that crude inventories have dropped by 809,000 barrels to 377.4 million last week. Positive inventories report outshined disappointment that Federal Reserve chief Ben Bernanke has refrained from offering any explicit hint of further monetary-policy stimulus. In addition, the impact of the US and EU sanctions on Iran raised supply concerns. The effect of the sanctions accounted for losses of 1.2m b/d. Sugar Futures extended gains rising to 23.92 cents a pound last Friday.

nGraph – Dollar Index & Gold weekly price movements

n

n

The Euro currency touched a two-year low of $1.2106 on a intraday basis on Friday after the European Central Bank said it would stop accepting Greek bonds as collateral and Spanish borrowing costs hit euro-era highs. Moreover, the Bank of Spain revealed that Spanish banks had movements€155.84bn of loans on their books in May that are at risk of not being repaid. The ZEW index of German investor and analyst expectations, which aims to predict economic developments six months in advance, fell to minus 19.6 in July from minus 16.9 in June.

n

Sterling swung between losses and gains last week. Sterling weakened versus the greenback after the IMF lowered its forecast for UK’s growth in 2012, down to 0.2% from the 0.8% indicated in April. However, the currency bounced back to end the week higher after inflation rate fell to 2.4% in June, from 2.8% in May. Furthermore, the number of people out of work in the UK fell by 65,000 to 2.58 million in the three months to May. The unemployment rate fell to 8.1% in the period, down from 8.3% in the previous quarter.