Markets remained at the whim of US fiscal cliff ahead of the festive period

Share

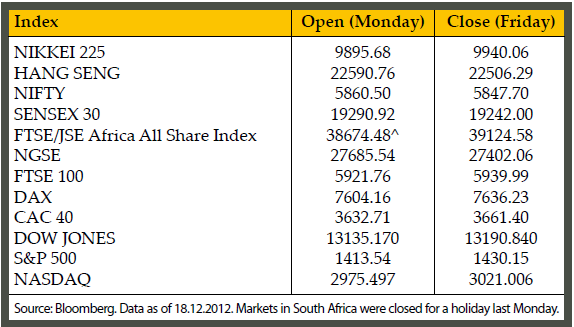

Global markets remained at the whim of the US fiscal cliff last week as fears that the world’s biggest economy may fall back into recession sapped investors’ confidence. In fact, continued US political deadlock is likely to place further downward pressure on risk-sensitive assets into the year end. However, investors had some upbeat economic data releases to cheer. In US, the economy grew by 3.1% in Q3, according to the latest revision by the commerce department. The figure was higher than the 2.7% annualised growth previously estimated for Q3. Personal income increased by 0.6% in November, while personal spending increased by 0.4%. The National Association of Realtors said sales of previously owned homes rose by 5.9% to a seasonally adjusted annual rate of 5.04 million last month and November durable goods orders increased by 0.7%. However, data showed that the fiscal cliff issue is already affecting sentiment with a sharp fall in the December reading of the University of Michigan’s consumer confidence index. In Europe, Eurozone consumer confidence edged marginally higher in December compared to the previous month. Additionally, Mario Draghi, head of the European Central Bank, said in a speech to a European Parliament committee that he expects the Eurozone economy to recover in the second half of next year. In Asia, the World Bank to raise its 2013 growth forecast for China to 8.4%, up from its earlier projection of 8.1%. The Bank of Japan boosted its key stimulus measure in an attempt to revive growth in the world’s third-largest economy. It extended its asset purchase programme, by ¥10 trillion to ¥76 trillion. On the equities front, the S&P 500 Index gained 1.2% while the Dow Jones Industrial Average added 0.4% last week. In Europe, stocks posted their longest stretch of weekly gains in four months led by a 12% rally in Alcatel-Lucent. In Asia, the Nikkei 225 gained 2.1%. Indian equities trimmed losses after India’s central bank left the repurchase rate at 8% and held the cash reserve ratio for lenders at 4.25% after a cut in October.

Gold swung between losses and gains last week. The precious metal lost almost $22 last Wednesday to settle below $1,650/oz after the US Commerce Department showed that US GDP grew at a seasonally adjusted annual rate of 3.1% in Q3, well ahead of economists’ forecast. Thus, a stronger economy will bring forward the day when the US Fed eventually starts unwinding its ultra-loose monetary policy, which may eventually hurt gold. However, gold bounced back on Friday amid some safe demand flows. Moreover, Brazil boosted its gold reserves with its holdings doubling since August. Its holdings rose by 14.7 metric tons in November to 67.2 tons.

Crude Oil Futures gathered steam last week as upbeat US economic data and weakness in the US dollar supported the black gold. Oil prices also rose after crude inventories fell by 1 million barrels in the week ended December 14, to 371.6 million barrels. On a further note, the Iraqi Oil Minister said that the country’s crude production will exceed 3.2 million barrels a day in December, higher than output of 3.17 million barrels a day in November. In fact, Iraq has risen this year to the rank of OPEC’s second- biggest producer. Sugar Futures rose to 19.25 cents a pound last week.

Graph – Dollar Index & Gold weekly price movements

The Euro currency traded above the $1.32 last week. The Ifo Institute said that its index tracking the business climate in Germany rose for a second month to 102.4 in December versus a November reading of 101.4. Furthermore, Standard & Poor’s rating agency raised credit rating of Greece’s sovereign debt to “B minus” from “selective default”. The rating agency said in a statement that the upgrade reflects the strong determination of European Economic and Monetary Union member states to preserve Greek membership in the Eurozone.

The British Pound retreated slightly on Friday after a downward revision to UK growth from 1% to 0.9% in Q3 2012. In addition, UK consumer confidence fell in December from an 18-month high, according to research company GfK NOP Ltd. However, the UK currency remained above $1.62 as inflation rate remained at 2.7% in November. Rises in food and energy costs were offset by cheaper petrol. The Yen weakened after Japan elected a new government which proposed raising the inflation target of the Bank of Japan as well as suggesting the central bank embarks on unlimited monetary easing.