US Fed chief left the door open to a third round of economic stimulus

Share

Global markets ended last week’s volatile trading session on a lower note as evidence of a slowing global economic recovery weighed on sentiment. The number of unemployed people in the Eurozone reached a record high of 18 million, with the unemployment rate at 11.3%. Moreover, German retail sales weakened unexpectedly in July from the previous month, showing a decline of 0.9%. Economic confidence in the Euro area fell more than economists’ forecast and Spanish GDP in the three months through June declined by 0.4% from the previous quarter. Adding to economic gloom, Catalonia claimed that it will request an emergency €5bn credit line from Spain’s central government as the region struggles to refinance its debts. In Asia, the Japanese government downgraded its assessment of the economy and retail sales in the country fell more than estimated in July. South Korean industrial production also fell in July. The US economy climbed at a 1.7% annual rate from April through June, up from an initial estimate of 1.5%. However, the figure remained below the 2% level. On the equities front, European equities declined for a second week. UK’s FTSE 100 lost 1.1% and France’s CAC 40 shed 0.6%. Shares of L’Oreal, the world’s biggest cosmetics company, fell by 4.8% to €96.19 as gross profit margin narrowed to 71% in the first half of 2012 from 71.5% a year earlier. Shanghai Composite Index lost 2.1% as Chinese industrial companies’ profits fell by 5.4% in July from the previous year to 366.8 billion Yuan. Shares of Samsung Electronics Co. shed 3.3% after a US jury ruled that the company infringed Apple Inc. patents. The S&P 500 Index increased by 0.5% on Friday but posted a loss over the week of 0.32%. Markets pared gains as the US Federal Reserve Chairman Ben Bernanke left the door open to more quantitative easing to stimulate the economy at a speech in Jackson Hole last Friday.

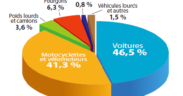

Gold Futures regained its lustre last Friday to settle at $1,675.9/oz. Ben Bernanke’s speech at the Fed symposium in Jackson Hole showed that the central bank would provide additional policy accommodation as needed, meeting market expectations that the door to a third round of economic stimulus would be left open. The central-bank asset buying would be positive for gold, which thrives on concerns about currency debasement. Mr Bernanke expressed grave concern over the stagnating US job market raising hopes among market participants that a disappointing jobs report this Friday will urge the central bank to act as early as the Fed’s meeting on September 12-13. The correlation between the US dollar and the gold is depicted in the graph.

GBOT WTI Crude Oil Futures gathered steam last week as investors grew concerned about Hurricane Isaac’s impact on production and refining in Gulf of Mexico. According to the US Bureau of Safety and Environmental Enforcement, the hurricane halted 95% of US oil production in the Gulf last week. Oil also gained after Ben Bernanke said he was open to more quantitative easing bolstering oil demand prospects. Sugar Futures rose to 19.78 cents a pound last Friday.

GBOT EUR/USD Futures saw a rebound last week closing above the $1.25 level as Spain sold €1.67bn in three-month bills, up from the €1.63bn sold at its last auction on July 24. The three-month borrowing costs fell to 0.946%, down from 2.434% at the last auction. In addition, Spain’s government approved some financial reforms aimed at accelerating reform of the banking sector. These include guidelines for the creation of a bad bank expected to take on failed loans and foreclosed property from commercial banks. The plan is crucial to the government unlocking €100bn of EU loans to recapitalise Spanish lenders.

GBOT GBP/USD Futures traded in a narrow range last week closing slightly higher at $1.5865. The average cost of a home in UK increased by 1.3% from July, the biggest monthly gain since January 2010. Furthermore, London-based research group GfK NOP Ltd revealed that UK consumer confidence remained unchanged in August. Japanese Yen gained as a safe haven currency after figures revealed an unexpected drop in the country’s industrial production.