Global markets struggled to regain their footing

Share

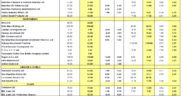

Global markets struggled to regain their footing in a volatile week which saw US President Barack Obama re-elected for a second term. Fears over the looming US fiscal cliff of tax increases and spending cuts coupled with concerns over the size and pace of Greece’s debt reduction weighed on investors’ morale last week. The threat of the fiscal cliff – $607bn of tax hikes and spending cuts that kick in at the start of 2013 is seen as the most important issue facing markets in the near term. According to Fitch rating agency, failure to avoid the fiscal cliff and raise the debt ceiling in a timely manner as well as securing agreement on credible deficit reduction would likely result in a rating downgrade in 2013. Furthermore, adding to the bearish sentiment were comments from European Central Bank President Mario Draghi who said that the European debt crisis is starting to hurt the German economy. Industrial output in the country fell by 1.8% in September while the European Commission also slashed its 2013 Eurozone Bloomberggrowth forecast from 1% to 0.1%. Markets trimmed losses as data showed that industrial output and retail sales in the world’s second-biggest economy (China) expanded by more than expected in October. In addition, inflation slowed to 1.7% in October from a year earlier providing further room to China to deploy pro-growth policy measures. Moreover, a strong reading from University of Michigan survey of US consumer confidence also supported sentiment. On the equities front, US equities posted their biggest weekly decline since June with the S&P 500 Index losing 2.4%. European equities also traded in negative territory last week. Crédit Agricole posted a €2.85bn loss in the third quarter as it paid heavily to terminate operations in Greece. Societe Generale reported last Thursday a decline of 86.3% in net profit in Q3 to €85 million. Asian equities ended in red last week. Moody’s Investor Service lowered Sony Corp’s long-term debt rating from Baa2 to Baa3 because of falling demand for its consumer electronics.

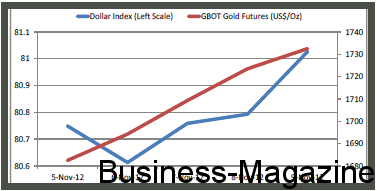

Gold Futures regained its lustre last week climbing above the $1,700/oz level. Mr Obama’s re-election is seen as bullish for gold because the Federal Reserve will likely continue its easing stance. Expectations of strong demand from India due to the “Dhanteras” festival also bolstered demand for Gold. Investors boosted assets in gold-backed exchange-traded products to an all-time high of 2,596.1 metric tons last week, valued at $144.7 billion. The correlation between Gold and US dollar is depicted in the graph.

WTI Crude Oil Futures veered between gains and losses last week closing slightly above the $86/bbl. Oil prices rose buoyed by prospects for higher demand, following positive economic data out of China and the US. However, prices tumbled as crude supplies increased by 1.77 million barrels to 374.8 million barrels last week, according to the US Energy Department. Further, in its monthly report on Friday, the Organization of the Petroleum Exporting Countries trimmed demand forecasts for its own crude over economic concerns and rising output by non-OPEC producers. OPEC said demand for its crude will be about 100,000 barrels a day less than expected next year. Sugar Futures traded below the 20 cents a pound last week.

The Euro currency failed to recover after the Greek parliament narrowly approved a €13.5 billion package of additional austerity measures to secure another round of funding last Wednesday. The lack of action from the European Central Bank proved to be negative for the shared currency. The ECB refrained from taking more action despite signs of further economic slowdown. The European Commission cut its 2013 growth forecast for Germany to 0.8% from 1.7% forecast earlier. The Bank of France indicated that the French economy may be tipping into recession as industrial production slumped. Fears that Spain would not request a bailout until next year also weighed on the single currency.

GBOT GBP/USD Futures slid below the $1.60 level last week as the National Institute of Economic and Social Research claimed that the UK economy will remain in a period of depression for two more years. Additionally, the Bank of England kept its target for asset purchases at £375 billion and maintained its key interest rate at a record low of 0.5%.