A mixed performance across various asset classes

Share

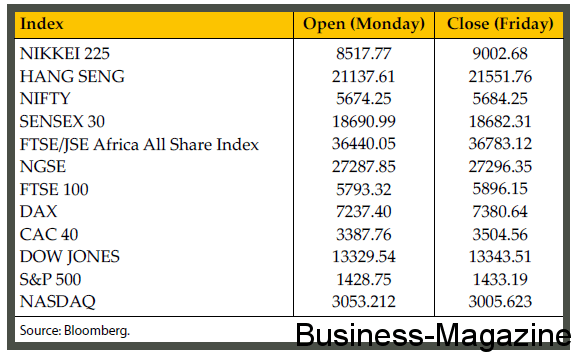

Global markets got off to a bullish start last week buoyed by better than expected earnings report from Goldman Sachs, United Health Group, Johnson & Johnson and Citigroup. Furthermore, Moody’s Investor Service kept Spain’s investment grade rating at Baa3 claiming that the risk of the Spanish sovereign losing market access has been materially reduced by the willingness of the European Central Bank to undertake purchases of Spanish government bonds. Furthermore, US retail sales rose by 1.1% in September and Chinese exports grew by 9.9% year-on-year in the same month. A closely watched monthly survey from the ZEW institute showed a better-than-expected improvement in German business sentiment. However, markets started to falter as from Thursday. China’s economy grew by 7.4% (Year on Year) in Q3, its slowest rate for three years and foreign direct investment in the country fell by 6.8% from a year earlier to $8.43 billion. US jobless claims increased by 46K to 388K in the week ended October 13 from a revised 342K the prior week. Moreover, large US companies, such as Microsoft and General Electric reported earnings that missed analysts’ estimates. Germany Chancellor Angela Merkel cast doubt on one of the main benefits of Eurozone banking union. Ms Merkel said that bad assets held by Spanish and Irish banks will not be cleaned up by the Eurozone’s new €500bn rescue fund. Global stocks veered between losses and gains last week. Germany’s DAX rose by 2%, while the UK’s FTSE 100 added 1.8%. France’s CAC 40 and Spain’s IBEX 35 each gained 3.4%. In Asia, stocks were mixed last week. Japan’s Nikkei 225 Stock Average gained 0.2%, while China’s Shanghai Composite Index shed 0.2%. In US, the S&P 500 Index posted a modest weekly gain of 0.3%.

Gold Futures slid to week low of $1,719.4/oz last Friday amid heightened risk aversion in financial markets. Market participants turned more cautious as worries about corporate profitability continued to affect investor sentiment. Moreover, uncertainty lingered in Europe after Ms Angela Merkel cast doubt on one of the main benefits of Eurozone banking union. The dollar has been trumping gold as the safest haven mainly because of liquidity in times of uncertainty. The correlation between Gold and US dollar is depicted in the graph below. Further, HSBC Holdings Plc lowered its 2012 average gold price forecast to $1,700/oz from a previous forecast of $1,760/oz.

Oil Futures fell after crude inventories rose by 2.86 million barrels in the week ended October 12 to 369.2 million barrels, according to the US Energy Department. In addition, US production rose for a sixth week to 6.61 million barrels a day while oil imports grew for a third week, up by 126,000 barrels a day to 8.35 million. Furthermore, weak US earnings rendered investors more nervous raising concerns that slowing economic growth will reduce oil demand. Sugar Futures rose slightly to 20.23 cents a pound last Friday.

Graph – Dollar Index & Gold weekly price movements

GBOT EUR/USD Futures finished last week’s trading session with modest gains. The Euro currency traded above the $1.31 level last Wednesday after Moody’s Investor Service confirmed Spain’s Baa3 ratings. Furthermore, Spain sold €1.5bn of benchmark 10-year bonds at an average yield of 5.458%, against 5.666% at the last comparable auction on September 20. In addition the country also sold €1.6bn of bonds maturing in 2015 and €1.5bn of debts due in 2016, which yielded 3.227% and 3.977% respectively. However, the shared currency trimmed gains towards the end of the week as German Chancellor, Angela Merkel cast doubt on Spanish bank aid and disappointing corporate-earnings drove investors towards the safe haven US dollar.

GBOT GBP/USD Futures hit a week high of $1.6164 last Wednesday as the UK unemployment numbers fell by 50,000 since August to 2.53 million, according to the Office for National Statistics (ONS). As per Bank of England’s October monetary policy meeting, members unanimously decided to maintain the quantitative easing programme unchanged at £375bn. The Japanese Yen weakened on market talk about government intervention after its exports slid 10.3% in September from a year earlier, leaving a trade deficit of ¥558.6 billion ($7 billion).